In our last PLM Atlas news post we answered the question What is The PLM Atlas? In this second of a three-part series we’ll address another frequent question; what incited its creation.

The underlying motivation to create a professional resource like The PLM Atlas was not financial in nature as this initiative to date has been a non-monetized endeavor. Instead, it was due to equal parts of appreciation and frustration for the engineering software and PLM-enabling technology markets I’ve been fortunate to participate in a variety of roles over several decades.

The need for The PLM Atlas originated from my experience first as an engineering software user in the aerospace industry, then applications support consultant, business development rep, sales channel manager, start-up founder, marketing consultant, and lastly an alliance and partnership builder with my PLM Alliances consulting practice.

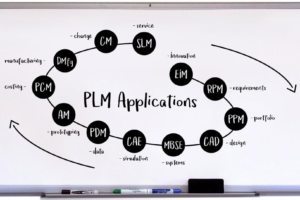

In each of these roles I had a front row seat to the ever-increasing width, depth, complexity, and interdependency of software solutions and their providers within PLM-related software markets. These engineering and manufacturing software markets include dozens of highly specialized segments like PDM, CAD, EDA, CAM, PPM, EDM, MBSE, CFD, CAE, CM, 3DP, VIZ, IoT, and many more as profiled in The PLM Atlas HERE.

These applications span the product lifecycle business functions of ideation, requirements planning, innovation, R&D, portfolio management, engineering design, simulation, virtual prototyping, testing, sourcing, manufacturing, quality, compliance, customer service, maintenance, repair, refurbishment, and retirement. Each of these functions can be further decomposed into smaller market segments that in totality are served by thousands of software and service providers around the globe.

Some may roll their eyes at so many niche markets and their corresponding three-letter acronyms, as if these terms are all just marketing hype. Yet, behind the lexicon these technology domains deserve recognition for all of the advancements they deliver which power continuous, if not disruptive, innovation across dozens of industries within the global economy.

Each of these software spaces have their own rich lifecycle history of entrepreneurial risk-taking, innovation, investment, disruption, adoption, extension, integration, maturation, evolution, consolidation, and regeneration. This PLM ecosystem is awe inspiring as it represents the very best of technology, innovation, capital uses, and entrepreneurship we can all be proud to have been part of in small and large ways alike. Future professionals may very well look back at these years as the “big bang” of technical software applications that made the digital revolution imaginable, then digital transformation possible.

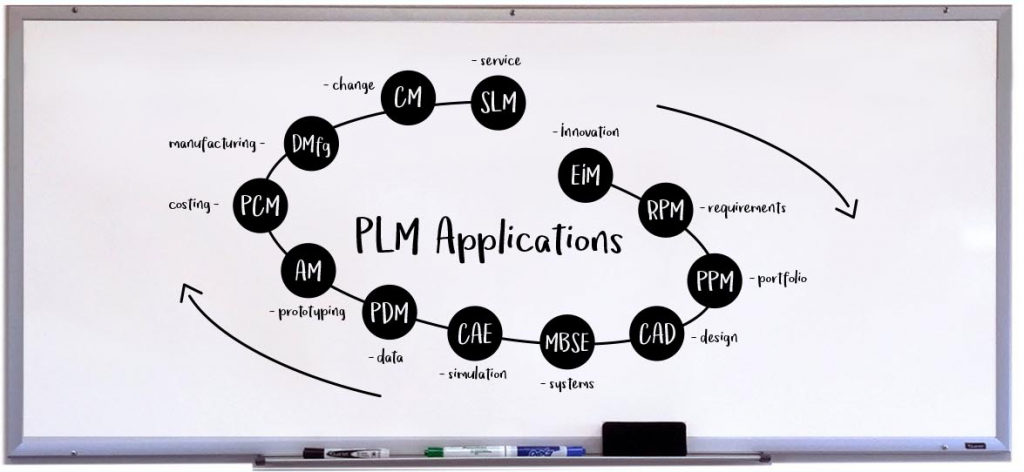

One of the most impressive attributes of this software industry is in its ability to innovate whole new technical disciplines and create new software categories. Examples are applications for 3D Printing (3DP), Multidisciplinary Design Optimization (MDO), Enterprise Innovation Management (EIM) and Lifecycle Sustainability Assessment (LCSA). Advancements in these new markets have typically been pioneered by small nimble Independent Software Vendors (ISVs) with little to lose and much to gain, especially compared to large enterprise solution providers that often already have too much to sustain.

However, this growth has also created new challenges and frustrations among industrial users and solution providers. The explosion of software products, solution providers, business strategies, technology scenarios, deployment options, integration schemes, and consulting partners has created a considerable burden of complexity in the process of identifying then researching all of the prospective resources and options within a domain. This burden is especially acute for those prospective users who are new to the industry and their managers responsible for providing approval, funding, and oversight.

Once upon a time there were a handful of enterprise providers who promised to be all things, providing applications in all segments to all of their customers in all industries. Despite such grand “all” promises, it was still easy and safe to buy from them. Experienced users and wise buyers now realize that no one solution provider, regardless of their size or funding, can deliver all that is needed given the pace of specialization, innovation and competition. And few businesses, large or small, want to be held hostage to a single enterprise provider, instead preferring an open-platform strategy composed of those specialized applications best aligned for their industry, business goals, and technical challenges.

As the PLM ecosystem has grown into a $60B-plus global industry, there are far more providers, applications, and partners, along with competing visions and strategies, to identify, consider, and evaluate. The era of open SaaS platform architectures has enabled a resurgence in best-of-class hyper-specialized software tools focused on solving specific problems within targeted industries by offering advanced capabilities that allow even non-expert users to reliably access.

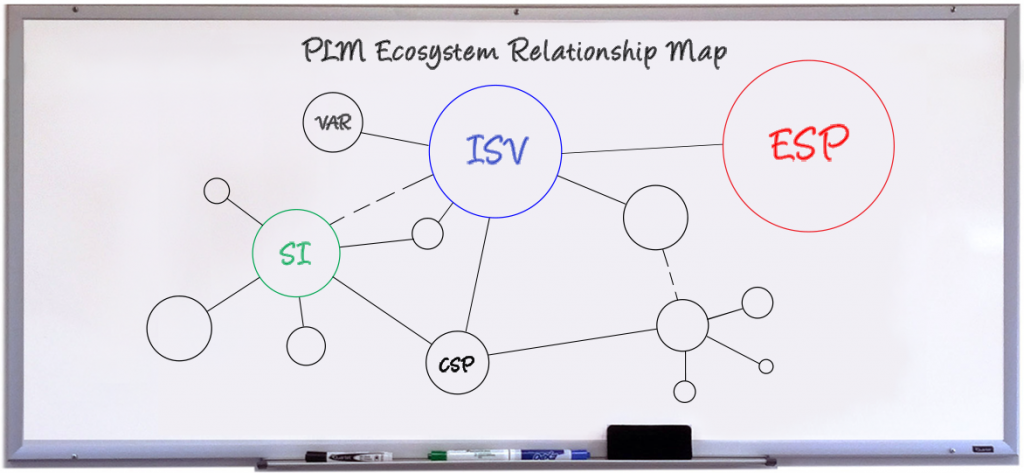

As a result, the role of the overall ecosystem has grown in importance as both new and old solution providers realize they cannot do it alone nor satisfy all customer needs by themselves. Another type of CEO, the Chief Ecosystem Officer, has emerged in org charts as the executive responsible for the relationships, partnerships, associations, communities, channels, integrations, and alliances within their business space. Discerning all of these relationships and their interdependencies has become a substantial exercise for providers and customers alike due to how quickly relationships can change, along with brisk merger and acquisition activity.

It may be a trivial exercise for the most experienced professionals to navigate through the expansive ecosystem landscape of engineering, manufacturing and supply chain software markets such as CAE, PLM, and SLM. Some will likely be familiar with a few of the more prominent solutions, though at the risk of missing the newest contenders. But it is a different story for less experienced professionals who undertake Internet research, software evaluations, or conduct trial uses. It’s largely a haphazard process where it is easy to overlook viable resources while overvaluing those that are found first or who find them.

Performing basic research from a desktop computer, much less a mobile device, is fraught with the risk of becoming distracted, sidetracked, or hijacked by ads, cookies, pop-ups, chat-bots, click-bait, and fake reviews loaded with misinformation. It’s made worse by Internet marketing algorithms that think they know who you are and what you want better than you do, then serve up what others have paid for you to see.

Most of us have experienced the frustration of conducting two identical searches on side-by-side computers or mobile devices and witnessing how different the results were as well as their order and of course the accompanying ads.

For software customers, it’s become all too easy to sign up for a free evaluation downloadable license or cloud access and spend hours if not days learning and using just the one application, leaving little time to compare it with others. Of course, that is exactly what some vendors are counting on; to wear you out before you have performed a thorough search and evaluation of all of the options.

For software providers, the marketing managers of new or small ISVs can attest that earning Internet visibility and search engine ranking is an exasperating game where the pay-to-play rules are constantly changing. Small software providers and independent consultants who typically offer the deepest expertise and best value can rarely afford the digital marketing investments required to consistently place on page one, and unfortunately get overlooked in the digital crowds.

Honestly, I think it was all much easier and reliable for users and buyers decades ago when they attended a few annual conferences and tradeshows each year where everybody was exhibiting – big or small, old or new – and walk the aisles, learning much while forming new relationships in the process. It was certainly more enjoyable compared to chat-bots pestering us and chirping away in our browser windows.

Admittedly, this was a time before the few remaining PLM conferences became vendor-specific Vegas show productions that sometimes feel like a cult following. During the COVID pandemic the alternative of virtual digital conferences, no matter how well executed, are just not that professionally rewarding. They leave one digitally fatigued instead of emotionally invigorated. A generation of professionals in our industry miss that experience of conferences and tradeshows where one large venue showcased all that was so inspiring about our profession.

The PLM Atlas is just one new tool that attempts to put more control back into the hands of those performing research, instead of in the algorithms of search engines and social media groups that have become agents of manipulation we can sadly no longer trust.

Begin to explore the website and let us know what you think with an email to [email protected] as we continue to build it out. Be sure to check out the listing for your company and send any corrections to us using this Submission Form.

In our next post we’ll profile a few of the real-world uses of The PLM Atlas. Until then follow our progress by registering to receive our news HERE.